newport news property tax rate

What Are Newport News City Real Estate Taxes Used For. Yearly median tax in Newport News City.

Paying Tax Popular Quotes Taxes Humor Words

By paying this tax we are able to increase the property tax collected for the city of Newport News.

. Taxing districts include Newport county governments and a number of special districts such as public hospitals. 757-247-2500 Freedom of Information Act. 757-247-2628 Department Contact Business.

Top Property Taxes Beaconsdale. The assessed value multiplied by the real estate tax rate equals the real estate tax. 0 2016 17 Beaconsdale La.

Commishnnvagov Hours of Operation 830AM - 430PM. You have several options for paying your personal property tax. Newport News VA 23607 Main Office.

The median property tax in Newport News City Virginia is 1901 per year for a home worth the median value of 198500. Unsure Of The Value Of Your Property. Newport News VA 23607 Phone.

The states give property taxation rights to thousands of community-based public entities. Newport News property tax is an excellent example of a tax that is paid for by properties that are not owned by us but are owned by our clients. Also if it is a combination bill please include both the personal property tax amount and VLF amount as a grand total for each tax account number.

The real estate tax rate will drop by 2 cents providing about 4 million in tax relief to city residents. Still property owners generally pay a single consolidated tax levy from the county. 19 Newport Avenue Newport News VA 23601.

Newport News VA 23607 Phone. Machinery and Tool Tax. Tiffany Boyle Commissioner of the Revenue Biography For General Inquiries.

Also if it is a combination bill please include both the real estate tax amount and stormwater fee amount as a grand total for each tax account number. Newport News City has one of the highest median property taxes in the United States and is ranked 506th of the. Newport News VA 23607 Phone.

Establishing property tax rates and conducting appraisals. How Newport News Real Estate Tax Works. You have several options for paying your personal property tax.

The current real estate tax rate for the City of Newport News is 122 per 100 of your propertys assessed value. When you use this method to pay taxes please make a separate payment per tax account number. 1399 per thousand Scroll down to learn about how we determine the taxable value of property.

The median property tax also known as real estate tax in Newport News city is 190100 per year based on a median home value of 19850000 and a median effective property tax rate of 096 of property value. Every entity then receives the assessment amount it levied. Ad Enter Any Address Receive a Comprehensive Property Report.

How Newport Real Estate Tax Works. Find All The Record Information You Need Here. Theyre a revenue anchor for governmental services in support of cities schools and special districts such as sewage treatment plants public safety services transportation etc.

757-247-2500 Freedom of Information Act. When you use this method to pay taxes please make a separate payment per tax account number. Still taxpayers generally receive a single combined tax bill from the county.

Newport News property tax is an excellent example of a tax that is paid for by properties that are not owned by us but are owned by our clients. Learn all about Newport News County real estate tax. Newport News City collects on average 096 of a propertys assessed fair market value as property tax.

Tax Rates for the 2022-2023 Tax Year. The median property tax also known as real estate tax in Newport News city is 190100 per year based on a median home value of 19850000 and a median effective property tax rate of 096 of property value. Collections are then disbursed to related entities per an allocation agreement.

Newport News VA 23607. The 104 billion budget proposes dropping the real estate tax rate by 2 cents to 120 per 100 of assessed property value. Along with collections property taxation includes two more common operations ie.

Receipts are then dispensed to related taxing units via formula. Please be aware that the Assessor does not set the real estate. Whether you are already a resident or just considering moving to Newport News County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

The rate will now be 120 per 100 of assessed property value. Our Tax Loan Experts Can Walk You Through All Your Options. Property taxes are the major source of income for the city and other local governmental districts.

If you would like an estimate of the property tax owed please enter your property assessment in the field below. Downtown Office 2400 Washington Ave. Its also a way of forcing local property owners to pay for infrastructure improvements such as.

Ad Johnson Starr Can Provide You with the Property Tax Loan You Need to Get Back on Track. See Results in Minutes. Refer to the Personal Property tax rate schedule for current tax rates.

New Hampshire code provides several thousand local public districts the authority to impose real estate taxes.

Property Tax How To Calculate Local Considerations

Riverside County Ca Property Tax Calculator Smartasset

Fbr Capital Gain Tax On Property In Pakistan 2021 22 In 2022 Property Finding Yourself Things To Sell

Rhode Island Property Tax Rates Town By Town List With Calculator Suburbs 101

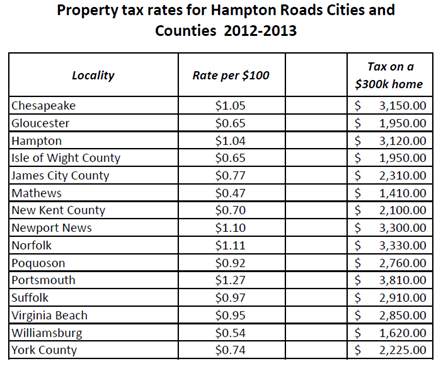

Hampton Roads Property Tax Rates 2012 2013 Mr Williamsburg

Mississauga Boasts 11th Lowest Property Tax Rate In Ontario Insauga

Your Guide To Property Taxes Hippo

Here S How Mississauga S Property Taxes Compare To Other Ontario Cities Insauga

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Tennessee Property Tax Relief Program Help4tn Blog Help4tn

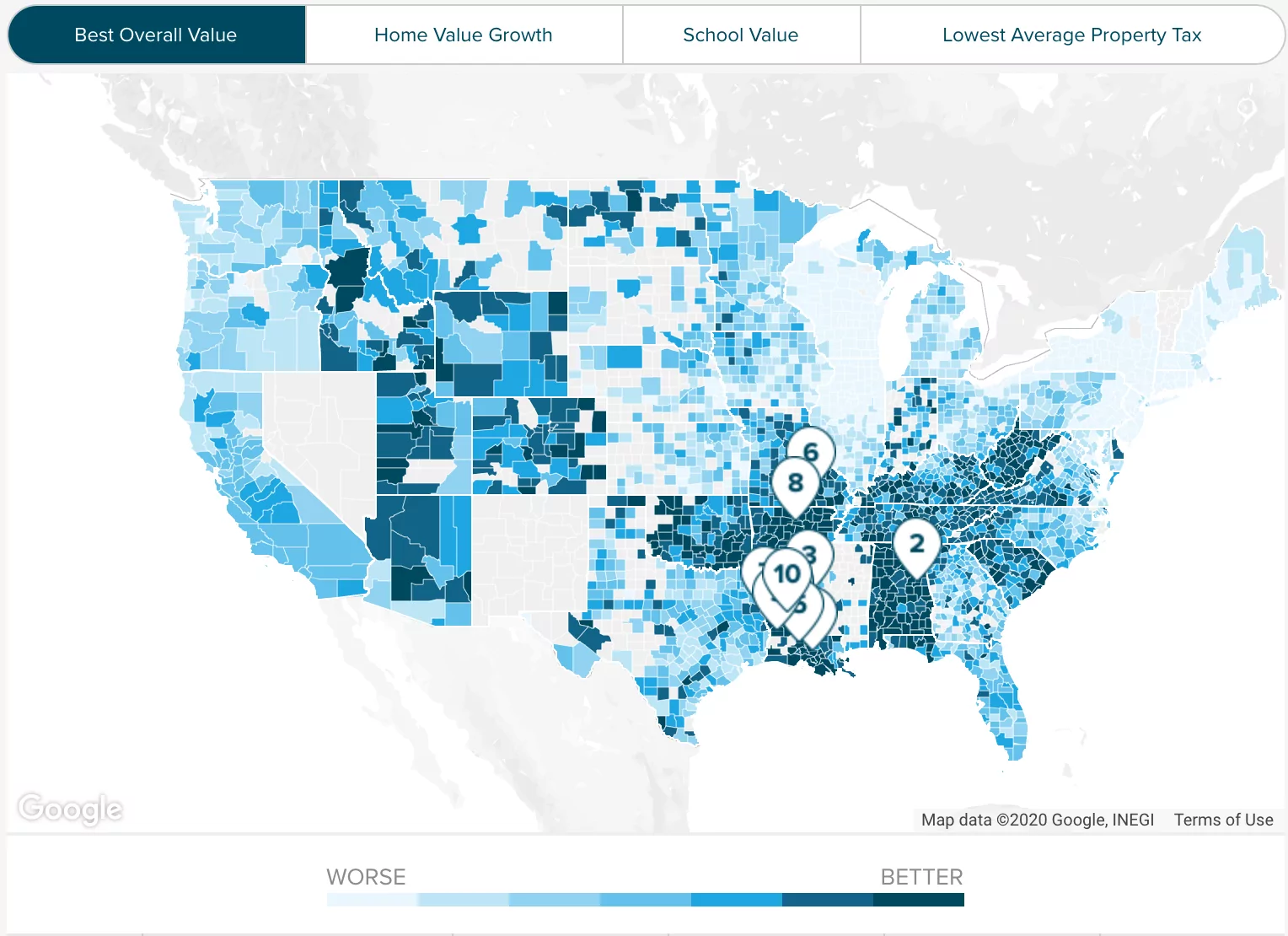

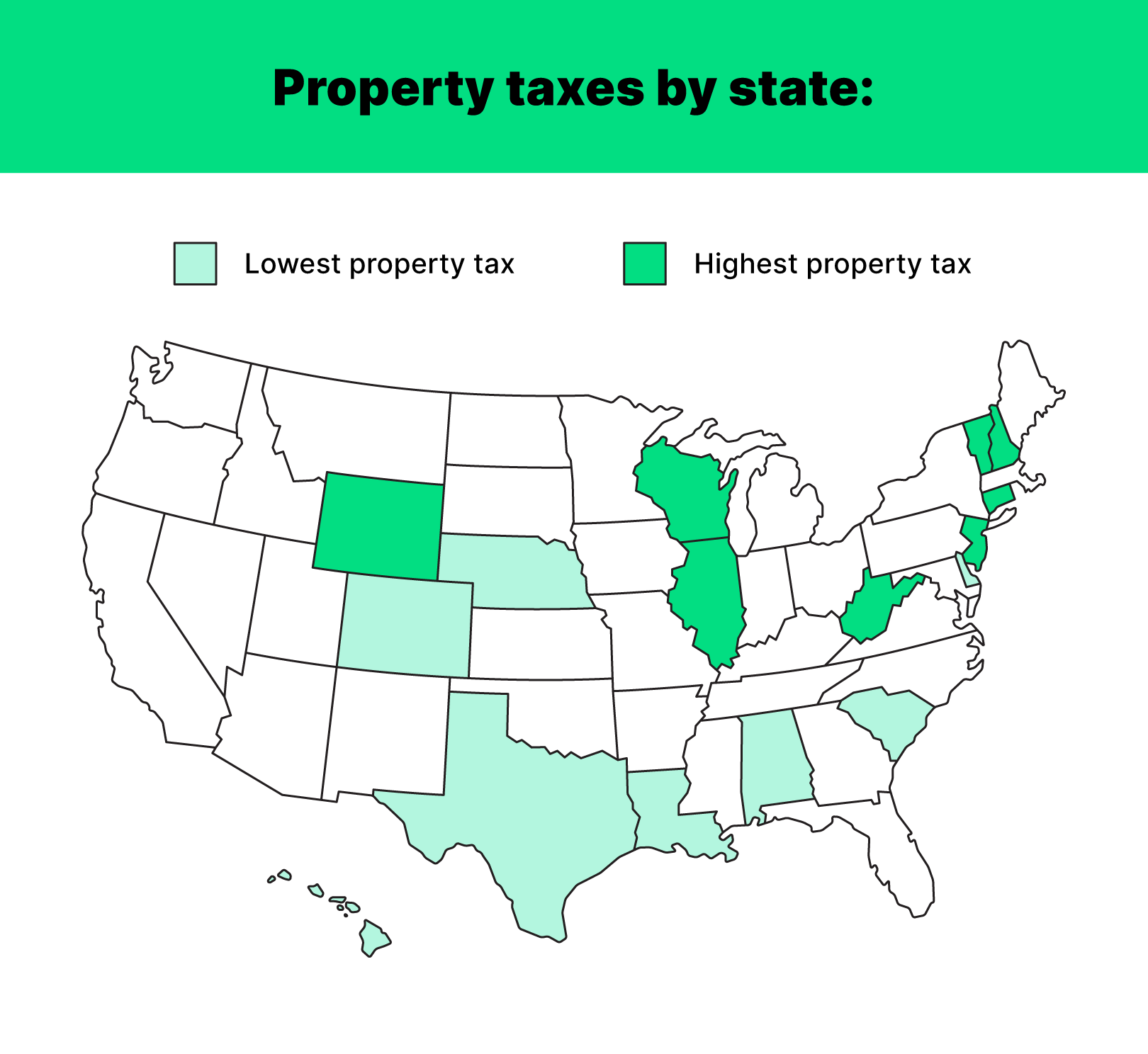

Want To Save A Few Bucks Where Property Taxes Are The Highest And Lowest

Newport Dads Invent Wishsaver Candle Ring Holder For Birthday Cakes Birthday Birthday Wishes Candle Rings

Tax On Income From Property In Pakistan In 2022 Separating Rooms One Bedroom Apartment Different Types Of Houses

Long Pond In Dracut Massachusetts England Homes New England Dracut

Coquitlam Property Tax 2021 Calculator Rates Wowa Ca

Nh Had Seventh Highest Effective Property Tax Rate In 2021 Report Says Nh Business Review

Realtymonks One Stop Real Estate Blog Tax Attorney Property Tax Tax